Ready to use legal template

Work on without any hassle

Compliant with Hong Kong law

Ready to use legal template

Work on without any hassle

Compliant with Hong Kong law

Home › Accounting › Invoice

Learn more about Invoice in Hong Kong

An Invoice is an official document issued by a seller to a buyer that records a transaction, detailing the goods or services provided, their prices, payment terms, and due dates. In Hong Kong, invoices play a crucial role in business transactions, serving as a legal record for accounting, taxation, and dispute resolution. While Hong Kong does not impose Value-Added Tax (VAT) or Goods and Services Tax (GST), maintaining proper invoices is essential for financial transparency and compliance with the Inland Revenue Department (IRD). Whether you are a business owner, freelancer, or corporate entity, issuing clear and well-structured invoices ensures smooth financial operations and minimizes risks. Download our easy-to-edit Invoice form in Word format, designed specifically for businesses in Hong Kong, to simplify your invoicing process and maintain proper financial records.

Table of contents

-

What is an invoice in Hong Kong?

-

What is included in this invoice form?

-

Is there a legal requirement to issue invoices in Hong Kong?

-

Do I need to charge VAT or GST on my invoices in Hong Kong?

-

Is it mandatory to include a TIN on an invoice?

-

Do invoices in Hong Kong require a company chop or signature?

-

What is the difference between an invoice and a receipt?

-

Can I issue an electronic invoice in Hong Kong?

-

How long should I keep invoice records for tax purposes?

What is an invoice in Hong Kong?

An invoice in Hong Kong is a formal document issued by a seller to a buyer, detailing the goods or services provided and requesting payment. While there is no statutory requirement mandating the issuance of invoices for every transaction, maintaining accurate invoicing records is crucial for businesses to ensure transparency, facilitate smooth operations, and comply with tax obligations.

Importance of Invoices in Business Operations

Invoices serve as essential records for both parties involved in a transaction. They provide evidence of the agreement, outline payment terms, and are vital for accounting and auditing purposes. For businesses operating in Hong Kong, proper invoicing practices support compliance with the Inland Revenue Department (IRD) requirements and help in accurate profit tax assessments.

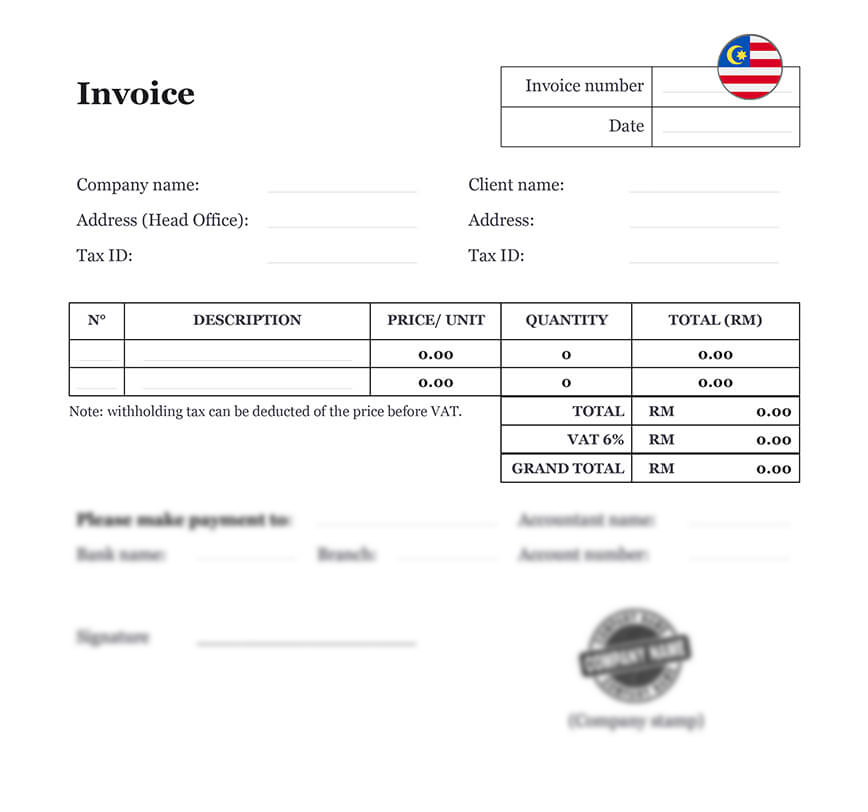

What is included in this invoice form?

Creating a comprehensive invoice is vital for clarity and legal compliance. While Hong Kong law does not prescribe a specific invoice format, certain elements are commonly included to ensure completeness and professionalism.

Essential Components of a Hong Kong Invoice

| ➤ Receipt Number & Date: Unique identifier for tracking transactions. |

| ➤ Company & Client Details: Includes names, addresses, and Business Registration Number (BRN) for proper identification. |

| ➤ Description of Goods/Services: Breakdown of items, price per unit, quantity, and total amount in HKD. |

| ➤ Invoice Reference: Links to the related invoice number and date if applicable. |

| ➤ Total & Tax Calculation: Displays subtotal, any applicable VAT, and the grand total. |

| ➤ Payment Information: Specifies the payment method (bank transfer, cash, cheque) and date of receipt. |

| ➤ Overpayment & Deductions: Notes any excess payment received and Withholding Tax (WHT) deductions. |

| ➤ Authorized Signature & Company Stamp: Confirms the receipt’s validity for business and accounting purposes in Hong Kong. |