Ready to use legal template

Drafted by experienced lawyers

Compliant with Hong Kong law

Ready to use legal template

Drafted by lawyers

Compliant with Hong Kong law

Home › Business contracts › Shareholders agreement

Learn more about Shareholders Agreement in Hong Kong

A Shareholders Agreement is a legally binding contract that outlines the rights, responsibilities, and obligations of shareholders in a company. It helps define how key decisions are made, how shares can be transferred, and how disputes are resolved, ensuring stability and clarity in business operations. In Hong Kong, where corporate governance is crucial for both startups and established businesses, a well-drafted Shareholders Agreement protects shareholder interests while ensuring compliance with the Companies Ordinance (Cap. 622). Whether you are forming a new company or restructuring an existing one, having a clear agreement in place can prevent conflicts and safeguard your investment. Download our Shareholders Agreement template, easy to edit in Word format and drafted by experienced lawyers to comply with Hong Kong laws and regulations, ensuring your business is protected from the outset.

Table of contents

-

What is a Shareholders Agreement in Hong Kong?

-

What is included in this Shareholders Agreement?

-

How does a Shareholders Agreement protect minority shareholders?

-

Can a Shareholders Agreement override company bylaws?

-

How do I transfer shares under a Shareholders Agreement?

-

How can a Shareholders Agreement impact dividend distribution?

-

What happens if a shareholder breaches the Agreement?

-

What are common exit strategies in a Shareholders Agreement?

-

How do you resolve disputes in a Shareholders Agreement?

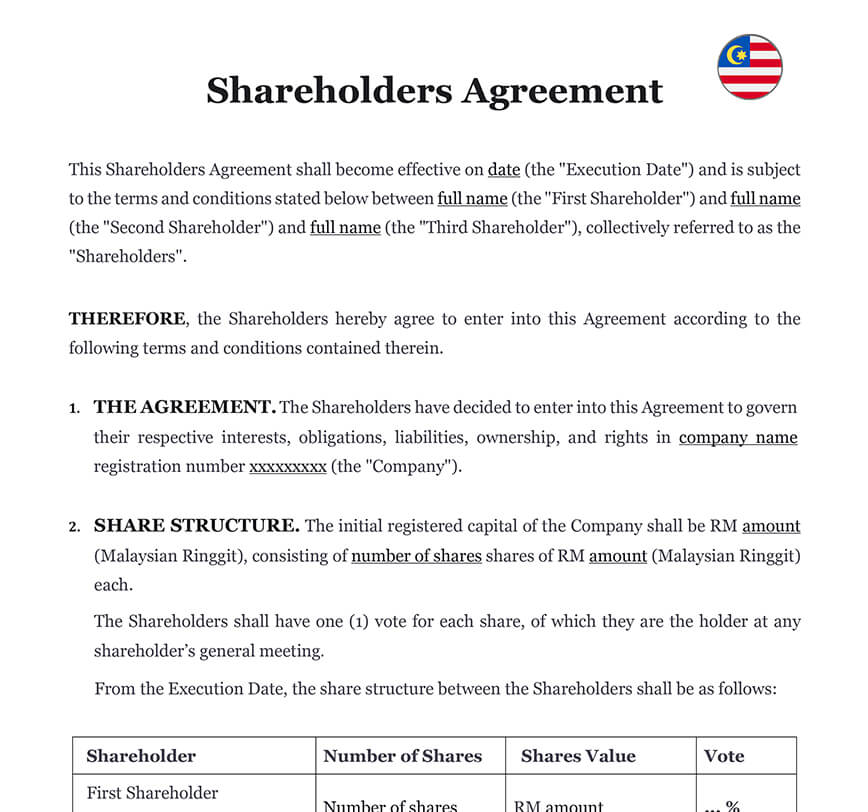

What is a Shareholders Agreement in Hong Kong?

A Shareholders Agreement is a legally binding contract between the shareholders of a Hong Kong company. It sets out their rights, responsibilities, and obligations, providing a framework for managing the company. Unlike the Articles of Association (which are publicly filed), a Shareholders Agreement is a private document that adds a layer of protection and confidentiality.

While not legally required under Hong Kong law, having a Shareholders Agreement is strongly recommended, especially when there are multiple shareholders. It helps prevent disputes, clarifies ownership rights, and sets the rules for decision-making, share transfers, and exits. You can find further legal context on Hong Kong’s Companies Ordinance on the official government website.

What is included in this Shareholders Agreement?

A comprehensive Shareholders Agreement in Hong Kong typically contains the following key clauses:

| ➤ The Agreement: Defines the purpose, confirming it governs shareholders’ rights and obligations. |

| ➤ Share Structure: Details capital structure in HKD, voting rights, and percentage of shares held. |

| ➤ Share Transfer: Sets restrictions on transferring shares, such as pre-emptive rights and third-party approval. |

| ➤ Shareholders Rights: Grants access to company financial records and ensures transparency. |

| ➤ Company Restriction: Prevents the company from giving financial aid to directors or shareholders. |

| ➤ Non-Competition: Prohibits shareholders from starting or joining a competing business in Hong Kong. |

| ➤ Non-Solicitation: Bans poaching of clients or employees during and after shareholder involvement. |

| ➤ Severability: Ensures the agreement remains valid even if some clauses conflict with Hong Kong law. |

| ➤ Termination: Outlines the conditions for ending the agreement, such as mutual consent or exit. |

| ➤ Company Liquidation: Explains how assets are distributed if the company dissolves. |

| ➤ General Provisions: States that modifications must be agreed upon in writing by all shareholders. |

| ➤ Force Majeure: Covers exceptional events like natural disasters or political unrest. |

| ➤ Governing Law and Jurisdiction: Confirms that Hong Kong law applies and disputes are resolved in local courts. |

| ➤ Documents Attached: Lists shareholder IDs and company registration documents. |